Blog

How to protect your pension share on divorce

The process for agreeing a financial settlement on divorce can go on for many months. Financial information is made available at the beginning of the divorce process, but what happens when these values change? This is particularly relevant for any stock market...

Case study: Consent order on divorce

A consent order is a financial contract between the 2 divorcing parties that sets out the financial obligations arising from their marriage. The contact is legally binding and enforceable. I am working with a client who was awarded a consent order several years ago as...

How to split your finances on divorce

I am working with a client at the moment who’s going through separation from her partner to calculate exactly what capital sum she needs now to cover essential expenses for her and her children. The brief details are that the couple are divorcing and the house is...

What happens to business assets on a divorce?

If you and your husband are divorcing and he has significant assets and money within his company, can these be taken into account as part of the financial negotiations? If you've heard the outcome of the recent case Petrodel v Prest you may be inclined to think that...

Changes to the state pension

With effect from April 2016 the government plans to introduce a single tier state pension of £144 per week in today's terms. This is a significant increase on the current basic state pension of £110 per week. However, it’s not all good news. The new proposals to...

Can your pension savings be too large? Your pension lifetime allowance

There are a number of tax advantages available to saving into a pension. For a revision of these see Pensions: a 20% off sale. You can save as much as you like into your pension plan but there is a limit on the amount of tax relief you can receive on your...

Dealing with pensions and finances on divorce

For many couples who are going through a divorce, the pension may be the 2nd biggest asset after the family home. It’s therefore vital that professional advice is taken as to what options are available for the pensions and which option is the most appropriate for you,...

Is my money safe in the bank?

In last week’s blog "How safe is the money in my bank deposit account" I looked at the Financial Services Compensation Scheme (FSCS) and how that can help depositors if their bank becomes insolvent. This blog looks more at the issue of is it a sensible option to leave...

How I saved my client £50,000 with her divorce

Divorce can be both a stressful and costly experience. Someone going through a divorce will always recognise that they need to pay solicitor fees. However, they may feel less comfortable paying for financial advice. This may be because sometimes the financial adviser...

How safe is the money in my bank deposit account?

Having money in your bank deposit account is safe...or is it? All UK financial institutions with a banking licence are covered by the Financial Services Compensation Scheme (FSCS), which is designed to protect your deposit if the bank were to become insolvent. The...

Aphrodite Angels

Aphrodite is the Greek goddess of beauty, love, and sexuality. Some may remember this from their schooldays. But here’s a little teaser for you: do you know who Aphrodite Angels are? Don’t worry if you don’t recall hearing about the Angels from school. This is...

What’s the difference between an IFA and a Financial Planner?

There are a number of terms used in the financial services industry to describe advisers. A few of the more common ones are Wealth Manager, Independent Financial Adviser (IFA), and Financial Planner. Do all these terms mean the same thing or are you likely to get...

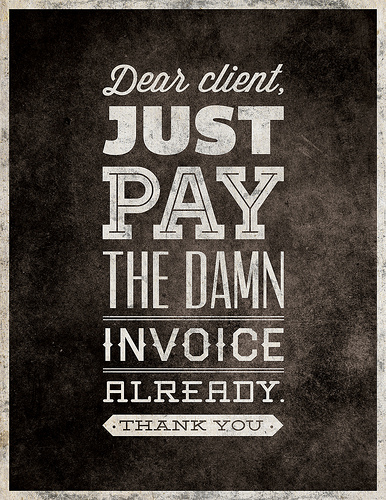

How does a financial adviser charge for their services?

Changes came into effect on 31st December 2012 which meant that commission can no longer be taken from a product provider to remunerate an adviser for the advice they gave to their client. Instead financial advisers will be paid by “adviser charging”. This rule...

Why seek financial advice?

Clients typically seek financial advice to get better control and understanding of their finances. Consider the following scenario and consider how familiar does it sound to you? You have a number of different pensions from previous employments. At the time the...

Help, should I consolidate my pensions?

It’s not at all uncommon for clients to have a large number of different pension pots which have been accumulated over a number of years, all with different providers. Often you start a pension with an employer but then when you change employment leave that pension...

What if you’re a stay at home mum and getting divorced?

It’s easy to think that you've stayed at home during your marriage bringing up a family, whilst your partner has gone out to work, that this will impact on the financial settlement you will receive when you are divorced. Since the partner who worked earned the...

Review your mortgage regularly

For most of us, our mortgage is the biggest financial commitment we have throughout our life. Given that it provides the security of a roof over our head, it is also one of the most important. As the largest commitment, it is crucial that you get it right, and get the...

How much is your credit card purchase costing you?

Interest on a credit card is currently around 17%, and could infact be as much as 23% if you are using a store card. If you buy something on a credit card (or indeed purchase with any form of debt) it’s very easy to look at how much you're paying back each month and...

What mortgage will you be offered following divorce?

Mothers who work part time or work in a low paid job to be able to fit their job around general child care, will often struggle after divorce to be eligible for any reasonable sized mortgage from a bank or building society. . Even if your partner has left the marital...

Claim child benefit to protect your state pension

To be eligible for a full state pension you need to have paid or received credit for National Insurance Contributions (NIC) for a minimum of 30 years. For each year less than 30, your full state pension is reduced by 1/30. That means that if you've paid NIC for 15...

Can I move my ISA if it underperforms?

What happens if after you've had your ISA for a period of time you notice the underlying investments are not performing? You're happy with the tax breaks you've received but decide the investment is no longer meeting your needs. Or maybe you simply wish to switch to a...

Help, how do I take control of my finances?

I had a meeting with a potential client last week who’d been following me on Twitter and as a result of my tweets had been motivated to get to grips with her finances. Hooray the message is getting through! The thing that confused her was “where to start?” If I was...

Getting Financially Ready for Divorce

Nobody wants to be faced with divorce. It is a challenging time in anyone’s life. When the rest of your world may feel out of control, it is important to take control over the things you can control. Getting financially ready can help you to feel more confident and...

What is that thing called collaborative law?

Separating and divorcing couples can now deal with issues arising upon the breakdown of their relationship by a process known as Collaborative Law. This process involves both parties signing up to an agreement which states, amongst other things, that they will not...

Help, where has all my money gone?

Does it sound familiar that no matter how much income you earn in a month it all seems to be gone by the end. You promise yourself that when you get a pay rise, or when you land that big contract, then you will start saving. But actually, you do get a pay rise, you...

Do you have enough money?

What if I were to ask you “how comfortable do you feel that you've got enough money to do what you’d like to do? I’m wondering how confidently you’d be able to answer this question. My guess is that most people really aren't sure how much they need. And I’m not...

Does your investment portfolio need a health check?

Once a financial plan has been put in place it’s tempting to believe the paperwork can be tucked away in a drawer and forgotten about, never to be looked at again. However, your plan needs to be reviewed on a regular basis to ensure you are on track to meet your...

ISAs explained: limits for 2013/14

What is an ISA? ISA stands for Individual Savings Account. In an effort to get us all saving as much as possible the government gives tax advantages when saving into an ISA. There are limits set each year as to what amount you can save in an ISA and receive tax...

What happens if you die without a will?

Research shows that over 28 million of the UK adult population (58%) are currently without a will[1] despite 92% of the population having a firm idea on who they would like their estate to pass to after they die. It is a common misconception that once you die your...

Pensions and Divorce: Pension sharing/splitting

Pension sharing is available where divorce proceedings began on/after 1st December 2000. The court will split the pension fund between the 2 parties, and the relevant part will be transferred from the scheme member to a pension fund in the name of the ex spouse. The...