Blog

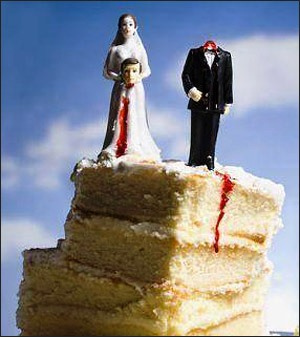

Pensions & Divorce – earmarking

Earmarking was introduced for petitions for divorce filed on/after 1st July 1996. Under this method the court allocates a specified portion of the scheme member’s lump sum, death benefits and income entitlement to the ex spouse. This is evidenced by an order from the...

Pensions on divorce: offsetting

Offsetting is the most common option used when dealing with pensions on divorce since it allows a completely clean break between the divorcing parties. Under this method the transfer value of the pension is included with the value of all other matrimonial assets. The...

Pensions and divorce: what are the options?

For many divorcing couples the pension may be the second biggest asset after the matrimonial home. The Pensions Act 1995 first introduced the requirement to take pensions into account on divorce under English Law. This requirement had been in place in Scotland since...

Will my state pension be enough?

Don’t think that if you don’t save for your retirement that the state will help in any significant way. Basic state pension at the time of writing is £5,587.40 pa which is a measly £466 per month. Anyone who thinks that’s enough for them to live the life style they...

Cohabitation agreements

The use of cohabitation agreements is currently a hot topic of discussion with the rights of those who cohabit and who are either not married or not in a civil partnership, very much in the news. It is estimated that almost six million couples are in cohabiting...

Pensions: a 20% off sale!

There are some attractive tax advantages to be had from investing in a pension. Are you aware of the pension tax benefits? If you’re not aware, read on to see.... Let’s assume you want to invest £100 per month in your pension. If you’re a basic rate taxpayer paying...

Mastering your Mindset for Financial Success!

Wealth is a state of mind and you can experience it right now! Quite simply how you think creates the actions you take, which in turn shows up in the results that you get in your life. To be a financially successful woman you need to think and act like one now! ...

Too young to start saving for retirement?

A bit like death and taxes, one thing we can all be certain of is that we will get older. When you're young retirement seems so far off that it’s not high enough on your priorities to want to do anything about it. Yes you know you need to get round to saving at some...

Jargon Buster: What on earth is an annuity?

If you're not sure what the Queen Mother has to do with annuities, then please read on. It will all become crystal clear! An annuity is a means whereby a capital sum is turned into income for your lifetime. You will often have heard the term in relation to pensions....

Help, finance is like a foreign language to me!

I frequently hear women tell me that they struggle with maths and don’t understand finance. If I had £1 for every woman who said to me “I don’t do maths”, I’d be a millionaire. I exaggerate of course I wouldn’t be a millionaire, because I don’t know a million women!...

Are you a “Common Law Wife?”

It is a widely held belief among women that if they are cohabiting but not married that they will have the same rights as a spouse should they and their partner later separate. However, this is a myth. I’m going to say that again just to make sure you heard correctly:...

Why a husband should pass all his assets to his wife!

To be strictly correct the proper headline for this article should be: “Why the higher tax paying spouse should pass their assets to the lower paying or non earning spouse”. But I love starting off with something controversial. Why put a sensible headline when you can...

Do women need different financial advice to men?

If you have a browse round my website you’ll see that I’m a female IFA specialising in independent financial advice to women. This naturally raises the question “Do women need different advice to men?” The answer of course is “No”. Financial advice is financial advice...