To be strictly correct the proper headline for this article should be: “Why the higher tax paying spouse should pass their assets to the lower paying or non earning spouse”.

To be strictly correct the proper headline for this article should be: “Why the higher tax paying spouse should pass their assets to the lower paying or non earning spouse”.

But I love starting off with something controversial. Why put a sensible headline when you can create havoc with a bit of controversy!

Women get tax rights too!

Can you believe that just over 20 years ago married women did not have to do their own tax return? This wasn’t because the Government decided that they didn’t have to pay tax. It was because it was the husband’s responsibility to do a joint tax return. The wife therefore provided all her financial information to her husband and he then completed the return.

Presumably it was thought that women had too much to think about with looking after the husband, the children & doing the washing & cleaning of the house. Why would she want to worry her pretty little head by doing something as difficult as dealing with her finances? After all, that’s probably why she got married…to have her man deal with this for her!

Whoever passed this law hadn’t bought in to my strapline “A man is not a financial plan”

Luckily for all us independent married women this is no longer the case. The rules changed on 5th April 1990, so only 23 years ago.

Good job they didn’t choose April 1st or it may have just been considered a good joke!

What this means for a non earning spouse

Each individual receives a personal allowance which for the tax year 2013/14 has been set at £9,440. If your earnings are below this amount you pay no tax. Above this amount you will suffer tax at 10%, 20%, 40% or 45% dependent on your total taxable income.

If you don’t use your full personal allowance you can’t transfer any unused portion to your partner. However, if one partner is a non earner (or low earner) and the other partner is paying tax at a higher rate, there is some basic straightforward tax planning that can be done.

What you can do

Ownership of joint assets or assets held in the sole name of the higher rate tax payer can be transferred to the non earning spouse. Dependent on the level of income some significant savings can be made. The level of saving depends on the specific circumstances but will be greatest when there is significant investment income suffering tax at 40% or 45% by one partner and the other partner is a non earner or low earner.

How do I do it?

Any income on assets held jointly (including rental on an investment property) is deemed by the tax authorities (HMRC) to be split equally between the joint owners. If you want to change this ratio you would need to complete a deed of declaration to show that the legal ownership has changed. You then submit Form 17 to HMRC. http://www.hmrc.gov.uk/forms/form17.pdf

Is there a downside?

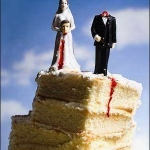

Do be aware that signing a declaration to say one party owns say 90% of a jointly held asset makes that person the legal owner of it. In a separation or divorce that spouse is deemed to be the owner. It is no longer split 50:50.

So if you and your husband or your civil partner suffers tax at differing rates, do consider this as a relatively easy way to reduce your tax burden.

If you’d like to talk to me about your specific circumstances and whether this would be appropriate for you please do call me on 01932 698150 or send me an email [email protected]. I’d love to have a chat with you about it.